Not everyone has the privilege of growing up in a wealthy family, and many of us were raised in households where resources were scarce. In this article, we explore the survival habits that people often develop when they grow up with limited means.

DIY Repairs and Projects

The need to save money turns into a knack for fixing and creating things by hand. This includes mending clothes by hand instead of buying new ones, learning basic repair jobs, and making handmade gifts for holidays.

Resourceful in Entertainment

Entertainment doesn’t have to cost a dime when you know where to look. You can entertain yourself by attending free community events, making use of public libraries for books and movies, and going out in nature.

Strong Value for Education

Education is seen not just as a pursuit of knowledge but as a ladder to a better life. According to the sociology journal Longdom, education is the best way to elevate one’s social class, and poor people are taught this from the start.

Thrifty Shopping Habits

Growing up poor teaches the value of every penny, making thrifty shopping second nature. People who grew up poor need to learn how to give life to secondhand items, as they know they are their only option in many cases.

Exceptional Budgeting Skills

Learning to manage money efficiently is a survival skill honed from a young age among those who grow up with nothing or less than others. Without saving money, poor people risk financial ruin in the event of any unexpected occurrences.

Creative Meal Prepping

For poor people, it’s typical of them to want to stretch ingredients to make nutritious meals on a budget. This is not just about money; they tend to have less time as well. Luckily, with resources like Healthline’s weight loss meal plan, anyone can do this.

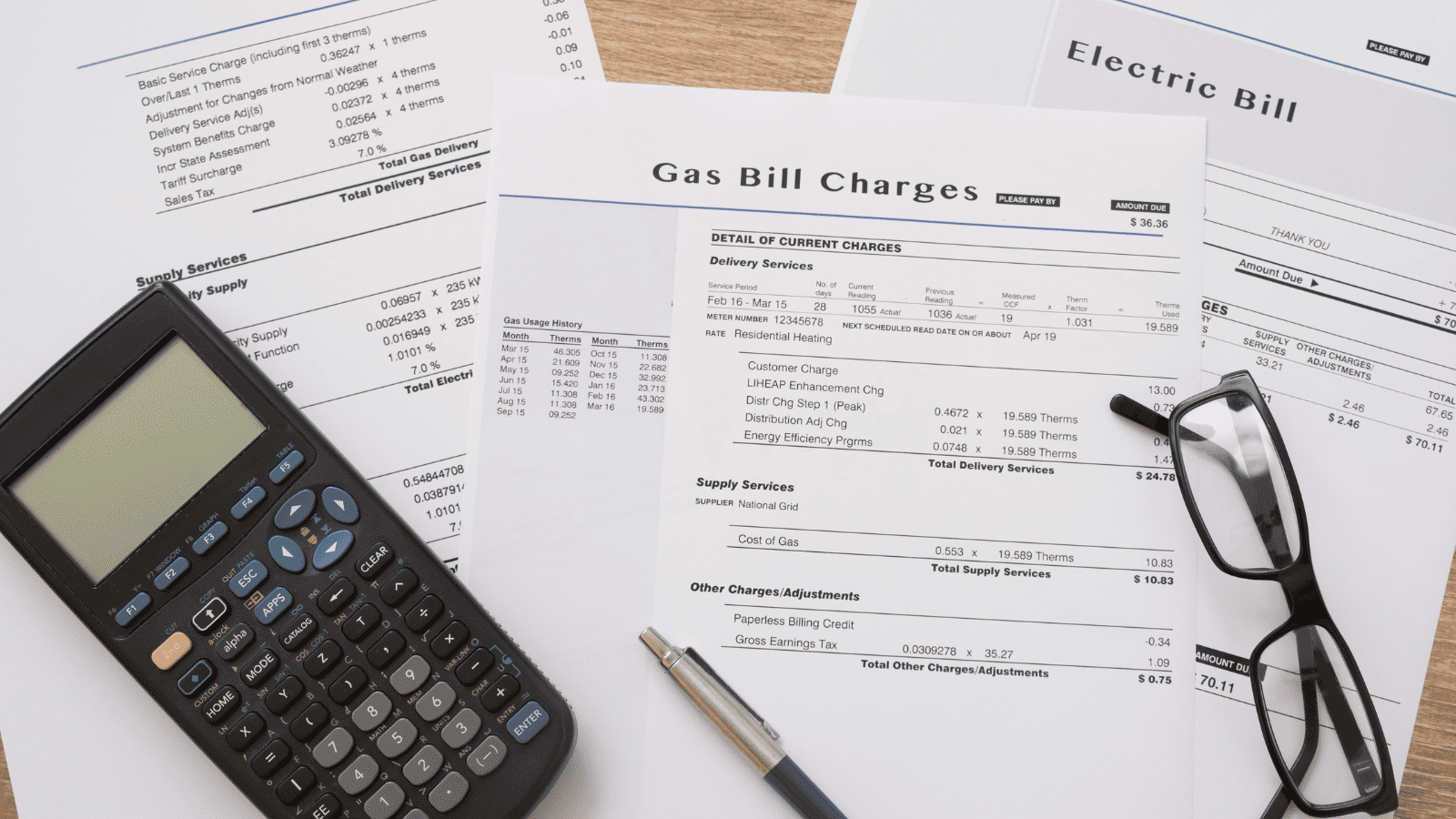

Energy Conservation Practices

When you have limited means, every utility bill saved is a step towards financial stability. Parents in poor households teach their children the value of using energy efficiently through habits like turning off lights, unplugging devices, and using energy-efficient appliances.

Avoidance of Wastefulness

We have slowly become a wasteful society, but this applies more to wealthier people than to poorer individuals. Lower-income people minimize waste through habits such as repurposing items before throwing them away and avoiding single-use products altogether.

Strong Saving Habits

Saving for the future is a top priority for individuals who grew up with financial constraints. They sometimes start by opening a savings account or simply putting away loose change. Unfortunately, research found that poor people have less savings despite their best efforts.

Bargain Hunting Expertise

If you have money, full-priced items might be the norm for you, but that is not the case for the less fortunate. For them, finding the best deals sometimes becomes a thrilling challenge. They know to keep an eye out for clearance sales and know the best times to shop for deals.

Strict Approach to Luxuries

For those accustomed to a life of poverty, luxuries are not bought on a whim. Instead, every non-essential purchase is carefully thought out, with a preference for meaningful experiences over material goods. It is no surprise that Forbes reports that millennials who have faced financial hardship are choosing experiences over material things.

Community and Relationship Building

When you grow up without much money, you quickly learn how important friends and community are. People in this situation often join in on community swaps and help each other out, creating connected groups that can be there for each other when needed.

High Adaptability

Being able to adapt is very important for those who have had to deal with not having enough money. They are really good at getting used to money situations and coming up with smart ways to solve problems, such as sudden car trouble or medical emergencies.

Doing Research Before Major Purchases

Impulse purchases are not the norm when you don’t have money, much less for expensive purchases. This includes things like cars, homes, and appliances, but can also apply to relatively smaller things like boots and raincoats. Poor people need to do this not just to save money but to make sure that they buy the best they can get for their money.

Minimalist Living

Minimalism has become mainstream, but for many, the lifestyle is not just a choice but a lesson learned from having less. When you don’t have enough, you don’t get to decide to have one couch; you are simply not allowed to.

Health Consciousness on a Budget

Staying healthy doesn’t have to be expensive with the right knowledge and habits. In fact, making your food from scratch not only saves you money but is also the best way to nourish your body with natural, unprocessed food.

Prioritization of Financial Security

Making sure to have a safety net of money is very important to people who grew up without much. In adulthood, they save up a cushion of money, buy insurance, and look into other ways to keep their money safe. For them, having financial security is their main goal because it means they can dream bigger and feel safe.

Self-Education in Financial Literacy

Living through tough times financially teaches you how to handle money better. You have to learn about making a budget, saving money, and how to invest it wisely. Without these skills, you are almost guaranteed financial problems in the future.